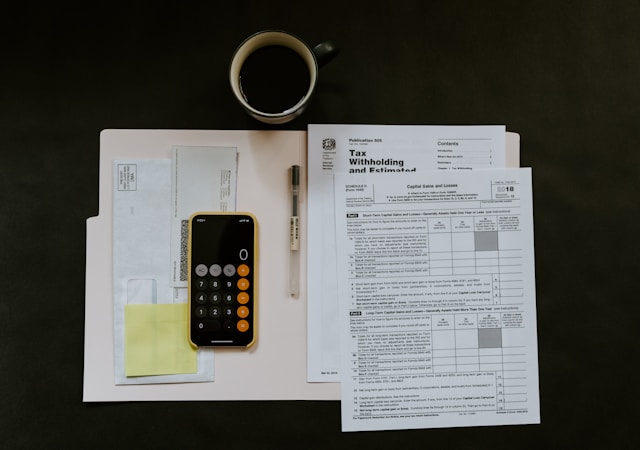

Get ready for the 2025 filing season

Preparation today paves the way for a worry-free tax filing experience in 2025By David Nosnik, CPA As the…

Preparation today paves the way for a worry-free tax filing experience in 2025By David Nosnik, CPA As the…

YES, the IRS employs different methods for conducting audits, and one of these methods involves audits by mail,…

Fraud involving the use of a deceased individual’s identity is a serious concern and can take various forms,…

You can receive non-refundable tax credits of up to $4,000 when purchasing a qualified used electric vehicle (EV)…

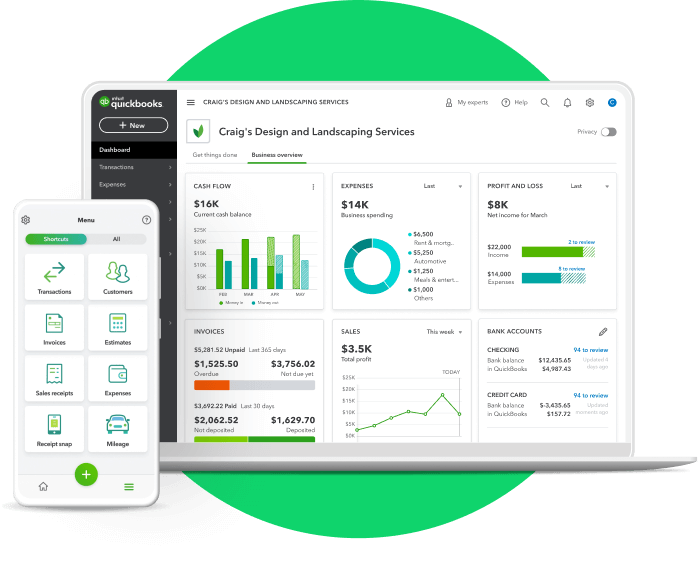

STUCK? EMAIL US YOUR QUESTION AT david@nosnik.com . We will get back to within one business day. The…

Due to widespread tax non-compliance, particularly among independent contractors, the Internal Revenue Service (IRS) has implemented measures to…

Ben Franklin aptly stated in a 1789 letter to Jean-Baptiste Leroy: “In this world, nothing can be said…

The Treasury Inspector General for Tax Administration has released a report, stating that as of February 25, 2023,…